07

06

05

04

03

02

01

In today’s competitive labor market, employers are under increasing pressure to deliver more value to employees while managing costs and compliance. Yet, many overlook a powerful lever hiding in plain sight: tax-advantaged benefit strategies.

Unlocking Hidden Value:

Leveraging a Tax-Advantaged�Benefit Strategy

17.9

%

78.2

%

93.8

%

0%

05%

10%

15%

20%

35%

30%

25%

Tap each item

2025

Employers can save up to $1,262 per employee annually by maximizing participation in tax-advantaged benefit accounts.1

Did you know?

Employers often fail to offer all the tax-deferred programs available

Traditionally, health and retirement benefits have been managed in separate silos — leading to missed opportunities for both employers and employees – including:

Failing to maximize participation in pre-tax programs, which can result in unnecessary payroll tax liability.

Employers pay 7.65% in FICA taxes on wages that could otherwise be sheltered through these programs.

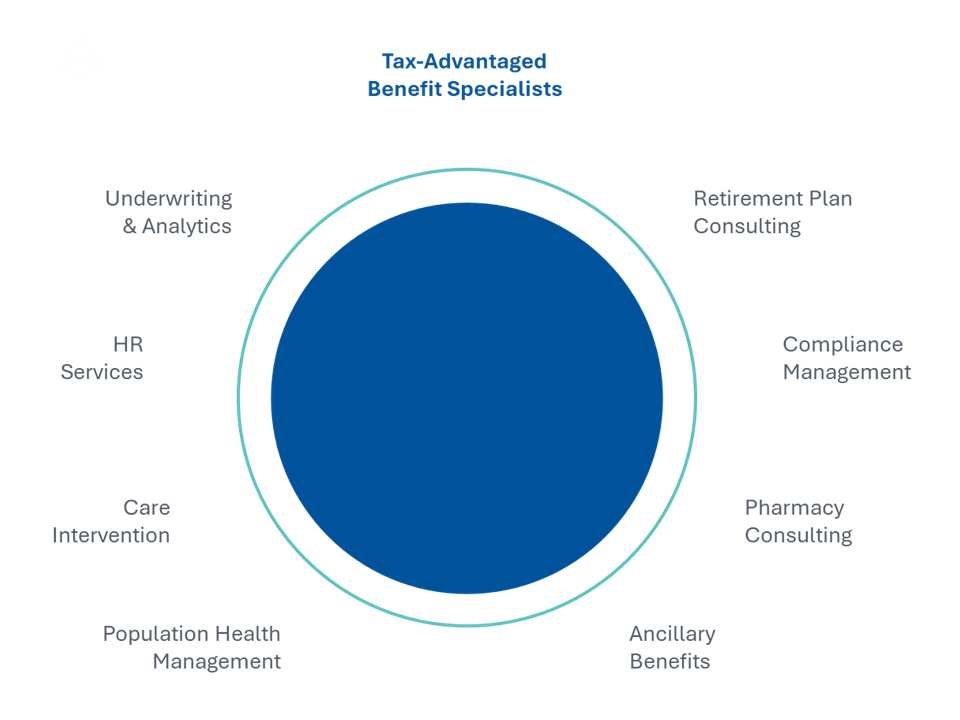

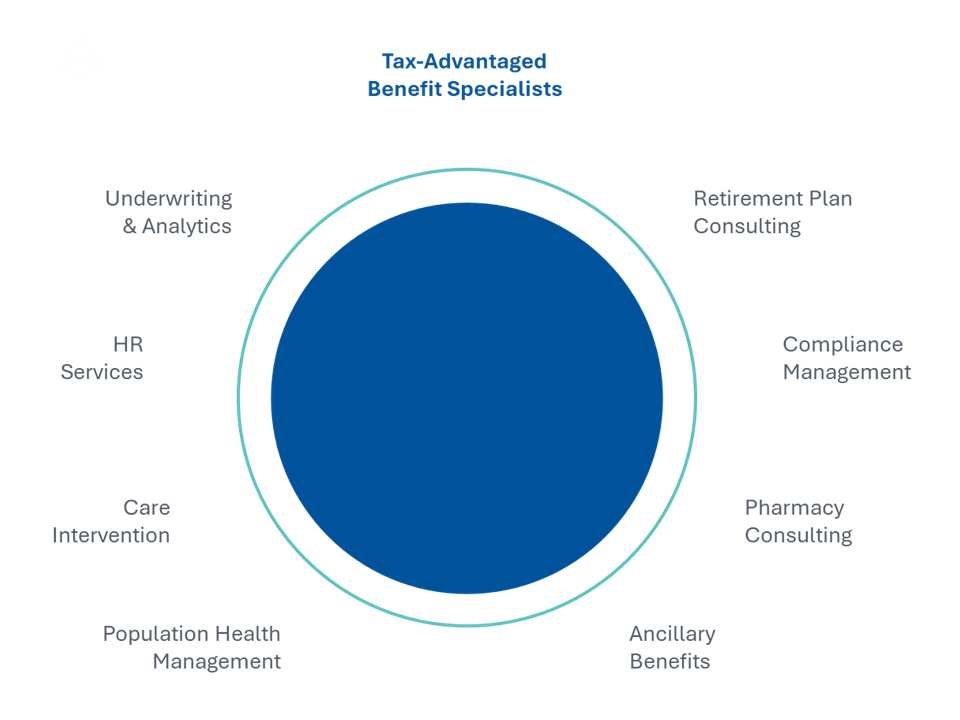

USI’s team is structured to help employers design comprehensive, holistic strategies across all benefit offerings.

Reduce employer tax liability by up to $1,483 per employee annually1

USI’s integrated model embeds retirement expertise within our employee benefits team, enabling specialists to design and implement comprehensive strategies that:

Improve plan participation and nondiscrimination testing

Educate employees on

optimizing their “next best

dollar” across tax-advantaged accounts

With an estimated $172,500 of health care costs in retirement,3 an HSA offers powerful advantages:

Triple tax benefit: No taxes going in, no taxes while growing and no taxes coming out for qualified medical expenses

Flexibility after age 65: Use HSA funds for non-medical expenses; withdrawals are taxed as income like a 401(k)

HSA vs. 401(k): The smarter way to save for health and retirement

HSA’s Superior Spending Power

HSA

401(k)

Assets

Investable

Investable

Contributions

Not Taxed

FICA taxed

Earnings

Not Taxed

Not taxed

Distribution for qualified medical expenses

Not Taxed

Taxed

Distribution for nonqualified medical expenses

Taxed

Require minimum distribution

Never

Yes (age 73)

Balance at age 60

$300,000

$300,000

Spending power

$300,000

$234,000

�$66,000

HSA savings compared to 401(k)

MAXIMUM�participation:

Up to $1,262

per employee

ENHANCED

$500–$600

per employee

AVERAGE participation:

$300–$400

per employee

Unlock Triple Tax Advantages and Unmatched Flexibility

A $300,000 HSA balance at age 60 has $66,000 more spending power than a 401(k) of the same size.5

Example

HSA

Contributions are tax-free

Funds grow tax-free

Withdrawals for qualified medical expenses are tax-free

Build Retirement Readiness While Reducing Tax Liability

Broader participation saves employers hundreds per employee in payroll taxes annually and helps plans pass nondiscrimination testing.

Pre-Tax 401(k)/403(b)

Pre-tax retirement savings help employees lower their taxable income today while building for tomorrow.

Enjoy Tax-Free Income in Retirement

Tax-free growth

Tax-free withdrawals in retirement

No required minimum distributions

No income limits

Higher contribution limits

Diversify your tax strategy with both pre-tax and Roth options.

Roth 401(k)

Expand Your Strategy Beyond Retirement

FSA

Transit Account

Emergency Savings Account

529 Plan

Tuition Reimbursement & Education Funds

Trump Account (2026+)

A well-rounded strategy improves employee engagement and reduces employer tax liability.

Additional Tax-Advantaged Accounts

Designing a tax-advantaged benefit strategy isn’t about checking boxes – it’s about unlocking the maximum value for your organization and your employees.

Let’s Build Your Strategy Together

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Learn More

1 Based on 2026 federal maximums, assuming the employee maxes out single HSA, limited purpose FSA, dependent care FSA and transportation accounts.

2 HSA is only available to enrollees in a Qualified High-Deductible Health Plan (QHDHP). This is illustrative of the federal tax treatment of HSA contributions. Some state income tax laws, like California and New Jersey, may treat HSA contributions differently.

3 $172,500 is the estimated cost of health care in retirement for a 65-year-old. Source: Fidelity Investments, 2025 Retiree Health Care Cost Estimate, July 2025.

4 As it relates to the health FSA that references a limited purpose or post-deductible.

5 HealthEquity, HSA Investment Guide, 2025.

Tax savings presented here are illustrative only and do not reflect actual savings. Actual savings will be dependent on a number of factors, including member participation, actual contributions, and performance of nondiscrimination testing. This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend that you seek independent advice specific to your situation from a qualified investment/legal/tax professional.

© 2026 USI Insurance Services. All rights reserved.

Fill out the form below and we can complete the analysis together to estimate your opportunity.

08

Example

Example

Example

Maximum�Participation

Up to $1,483�per employee1

Enhanced�Participation

$500-$600�per employee

Average�Participation

$300-$400�per employee

Employers that adopt a tax-advantaged strategy can expect to see these estimated tax advantages:

Did You Know?

Employers can save up to $1,483 in federal taxes annually for each employee who fully utilizes their tax-advantaged benefit accounts.1

Reduce employer tax liability by up to $1,262 per employee annually1

Improve plan participation and nondiscrimination testing

3 / 4

$36K

Premium

savings

2 / 4

0.94

Reduced e-mod

based on

evaluation

1.07

Original workers'

compensation

e-mod

1 / 4

At USI, we’ve reimagined how employers can integrate their health and retirement benefits strategies to reduce tax liability, boost employee engagement, and enhance financial wellness across the workforce.

USI

CLIENT

Thank you for your interest. A USI representative will contact you.

A Smarter Benefit Strategy

Employers often fail to offer all of the tax-deferred programs available:

Watch how to optimize costs without cutting benefits

Missed Opportunities

Integrated Benefits Strategy

A Holistic Approach to Tax Efficiency

Ready to �elevate your benefits strategy and save?

See How

Building a unified, tax-advantaged benefit strategy isn't just smart; it's essential. In a competitive labor market, it's a strategic advantage that pays dividends immediately and well into the future.

Strategies That Work

Maximizing Tax-Deferred Engagement

Quantifying the Financial Impact

The Power of HSA

(qualified distributions are not taxed)

(distributions are taxed)

(as ordinary income)

(as ordinary income after age 65)

Taxed

(as ordinary income after age 59-1/2)

HSA

Pre-Tax 401(k)/403(b)

Roth 401(k)

Additional

Tax-Advantaged Accounts

Which gives you more spending power at age 60?

$300K

HSA

+$66K more

spending power5

$300K

401(k)

Baseline

spending

power

Why the difference?

Triple tax-advantage

Tax-free healthcare spending

Keeps more of your investment gains

Save on payroll taxes & pass �nondiscrimination testing

Up to hundreds in payroll tax savings per employee annually

Easier plan compliance & nondiscrimination testing success

Greater participation makes a difference:

Higher enrollment

Increased plan participation

Stronger plan compliance

Enjoy tax-free income in retirement

Tax-free growth

No income limits

Tax-free withdrawals in retirement

No required minimum distributions

Higher

contribution limits

Diversify your tax strategy with both

pre-tax and Roth options

FSA

Transit Account

Emergency Savings Account

529 Plan

Tuition Reimbursement

Trump Account

A well-rounded strategy improves employee �engagement and reduces employer tax liability

Satisfied

Employees

Lower Payroll Taxes

Stronger Plan Compliance

Expand your strategy beyond retirement:

Get the FREE money

EMPLOYEE STRATEGIES

EMPLOYER STRATEGIES

USI recommends a “next best dollar” approach to help employees maximize tax‑advantaged accounts and reduce out‑of‑pocket costs. With the right mix of benefits, education and easy‑to‑use platforms, employers can drive higher participation, improve financial outcomes and get more value from their benefit spend.

HSA and 401(k)/403(b) up to employer match

Fully leverage TRIPLE tax-advantaged HSA

Max out HSA or spend on eligible healthcare expenses

Optimize engagement to maximize tax advantages of HSA and 401(k)/403(b)

Maximize HSA and 401(k)/403(b)

Implement automatic enrollment and escalation

Offer at least one HDHP option

Consider HSA match

Partner with your HSA vendor for spend/save/invest support

Save for the Future

Build your future nest egg

Leverage FSA

Minimize tax impact on out-of-pocket costs

Max out 401(k) contributions

Emergency savings account

Health and dependent care FSA

Support Asset Protection and Financial Education

Protect assets

Supplemental insurance

Offer more ways to save

Emergency savings account

Offer additional tax-advantaged benefits

General and limited purpose FSAs up to plan maximums

Offer asset protection and financial education

Supplemental insurance

Navigation and support tools

2

4

In today’s competitive labor market, employers are under increasing pressure to deliver more value to employees while managing costs and compliance. Yet, many overlook a powerful lever hiding in plain sight: tax-advantaged benefit strategies.

Did You Know?

USI’s integrated model embeds retirement expertise within our employee benefits team, enabling specialists to design and implement comprehensive strategies that:

FSA

Transit Account

Emergency Savings Account

529 Plan

Tuition Reimbursement

Trump Account

FSA

Transit Account

Emergency Savings Account

|

Privacy

Copyright

Disclaimer

|